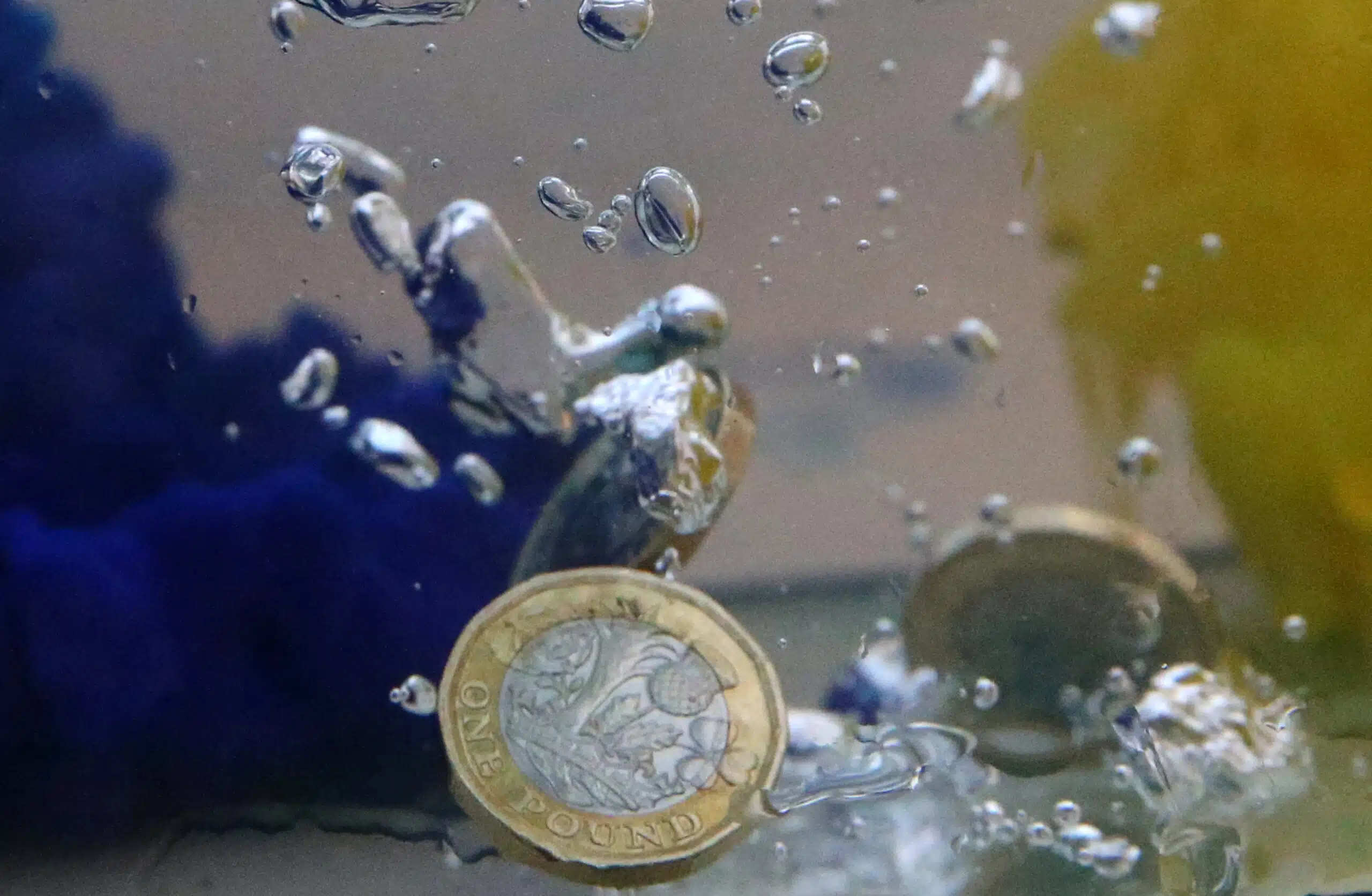

- The appreciation of Pound Sterling continues unimpeded, notwithstanding the unfavorable factory data observed in the United Kingdom.

- UK companies have significantly reduced input expenditures due to a challenging demand forecast.

- The Bank of England’s esteemed economist, Swati Dhingra, preferred a reduction in interest rates if the growth rate fell below anticipated levels.

The Pound Sterling (GBP) is currently experiencing significant selling pressure due to market participants’ diminished risk appetite, triggered by the recent weakening of the stable United States fundamental Consumer Price Index (CPI) for September.

The prospects for the GBP/USD pair have been diminished as the Office for National Statistics (ONS) has released a report indicating that the manufacturing data in the United Kingdom experienced a contraction for the second consecutive month in August.

UK firms experienced a reduction in operational capacity as they pursued the objective of enhancing efficiency by strategically removing inventory backlogs and corresponding labor forces in response to a decline in demand.

Anticipated is a deceleration in demand and a decrease in aggregate production, poised to cause unease among Bank of England (BoE) legislators as they prepare for the forthcoming interest rate determination in November.

Katherine Mann of the Bank of England preferred additional policy measures to reduce inflation to the target of 2% within an appropriate timeframe. Conversely, Swati Dhingra, also of the central bank, advocated for a potential reduction in interest rates if the growth rate deviated unfavorably from projected expectations.

The Attractiveness of the Pound Sterling Is Waning as Market Mood Weakens

- The Pound Sterling exhibits a lack of resilience as the prevailing market sentiment becomes subdued after a modest decrease in the anticipated US core inflation. The Pound Sterling was adversely affected by the subpar factory data observed in the United Kingdom during August.

- The Monthly Industrial Production experienced a contraction of 0.7%, surpassing the projected decline of 0.2% as anticipated by investors. During the time above frame, the decrease in Manufacturing Production surpassed initial projections by a factor of two, reaching a level of 0.4%. In July, the factory data experienced a contraction exceeding 1%.

- The annualized Industrial Production figure registered at 1.3%, falling short of the projected 1.7% but surpassing the previous reading of 1%. The Manufacturing Production rate of 2.8% fell short of anticipated levels, trailing behind last month’s figures of 3.4% and 3.1% in July.

- The monthly Gross Domestic Product (GDP) experienced a growth of 0.2%, aligning with the anticipated projections. In July, the overall output was a contraction of 0.6%.

- The factory data has experienced a consecutive contraction as UK firms have implemented reductions in inventory and labor in response to a challenging demand outlook.

- In the current scenario, investors exhibit divergent sentiments regarding the Bank of England’s perspective on interest rates, given the prevailing circumstances of the UK economy operating at an inflation level that surpasses the targeted rate of 2% by a factor of over three.

- In a recent statement, Katherine Mann, a policymaker at the Bank of England, expressed the view that central bankers ought to embrace a proactive stance regarding interest rates. The central bank’s primary objective is to address the escalating inflation expectations while concurrently prioritizing the reduction of inflation to a target rate of 2%.

- In contrast to the perspective presented by Mann, Swati Dhingra, a policymaker at the Bank of England, has expressed the view that the United Kingdom’s economy has experienced a state of stagnation. Furthermore, Dhingra suggests that a significant portion, approximately 25%, of the repercussions stemming from elevated interest rates have already been assimilated by the economy. The individual preferred an expeditious reduction in interest rates if the economic growth rate were to fall below anticipated levels.

- The persistent risks associated with a potential rebound in inflation are primarily attributed to the deepening tensions in the Middle East, which are anticipated to maintain a state of tightness within the oil market until 2024. Furthermore, the potential involvement of Iran in the ongoing Israel-Hamas conflict has the potential to disrupt the existing supply chain significantly.

- The potential absence of energy within the UK economy resulting from disruptions in the supply chain has the potential to expedite the escalation of headline inflation. Consequently, UK Prime Minister Rishi Sunak may encounter challenges in fulfilling his commitment to reduce inflation by half, specifically to a level of 5.2%.

- The US Dollar Index exhibits a notable resurgence after the release of the inflation report for September, which predominantly aligns with projected estimations. The headline Consumer Price Index (CPI) experienced an expansion exceeding initial investor expectations, registering a growth rate of 0.4% compared to the anticipated 0.3% growth. The monthly and annual core inflation figures were consistent with expectations, with a recorded speed of 0.3% and 4.15%, respectively.

- In the current landscape, it is worth noting that the Federal Reserve’s anticipation of an additional interest rate increase has diminished. This shift in sentiment can be attributed to the growing concern among Fed policymakers regarding the escalating US Treasury yields.

The Value of the Pound Falls Sharply to Around 1.2250

The Pound Sterling is currently experiencing selling pressure as it approaches the significant resistance level of 1.2300 due to an improvement in market sentiment. The current risk assessment maintains a cautious stance, as the potential involvement of additional nations in conflicts within the Middle East poses a substantial threat to the global supply chain.

The currency pair known as the Cable has demonstrated an upward movement, surpassing the 20-day exponential moving average (EMA) level at 1.2280. This occurrence signifies a shift towards a positive short-term trend.